Explore the top 10 benefits of hiring an education consultant...

Read More

How to Save Money While Studying in the UK: 9 Proven Ways

So, how can you actually save money as a student in the UK? The answer lies in smart budgeting, using student discounts, and adopting simple daily habits that help you stretch every pound further.

Studying in the UK is exciting but expensive. According to the Student Money Survey 2024, students spend an average of £1,104 per month, while loans cover only about £600, leaving a £504 shortfall. Over 80% worry about money, and 67% sometimes skip meals to save.

Building money-saving habits early is key. This guide shares practical tips to cut costs on rent, food, travel, and study essentials—helping you manage finances and enjoy student life.

9 Proven ways to save money as a student in the UK:

- Set a Realistic Budget and Track Every Spending

- Maximising Student Discounts and Perks

- Shop Second-Hand for Clothes, Books, and Furniture

- Cook at Home and Batch Meal Prep

- Leverage Free University Resources

- Invest in a Railcard or Bus Pass

- Pick Up a Flexible Side Hustle

- Budget Nights Out with Cash and Pre-Planning

- Build an Emergency Fund Early

1. Set a Realistic Budget and Track Every Spending:

Start by creating a realistic budget that matches your income and expenses. First, assess all your income sources—maintenance loans, grants, bursaries, and part-time earnings—so you know exactly what money you have each month.

👉Set Clear Budgeting Goals

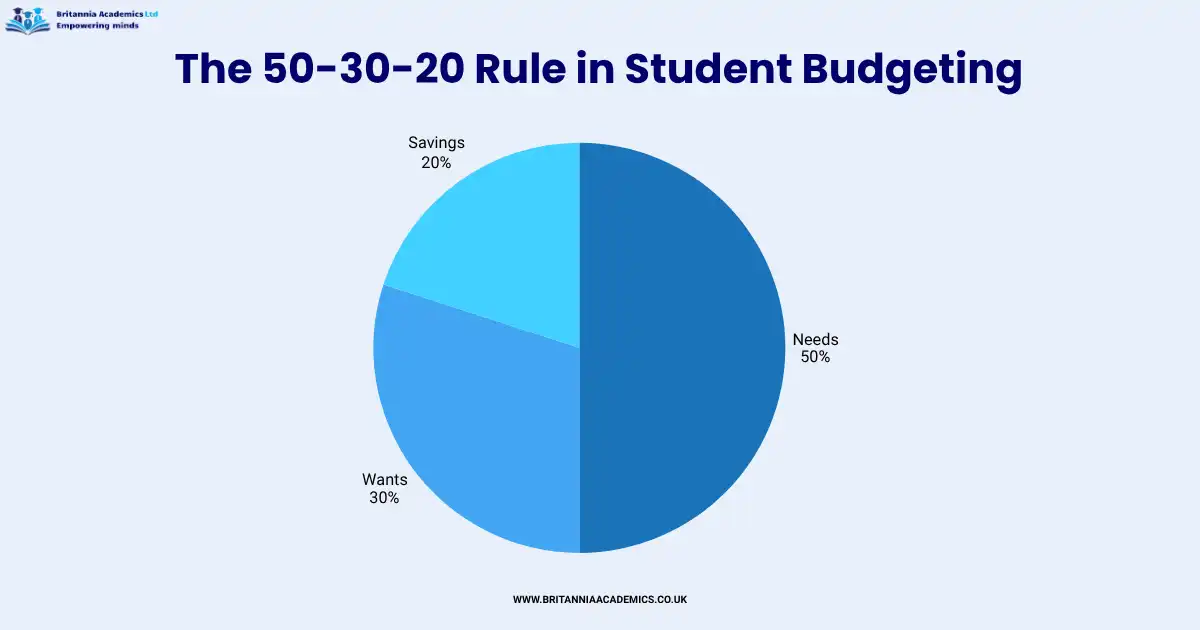

Many students find it helpful to plan monthly rather than termly, breaking spending into essentials, wants, and savings. A practical approach is the 50/30/20 rule adapted for students.

- 50% of your income to essentials like rent, bills, and food;

- 30% want such as social outings or hobbies; and

- 20% to savings or emergency funds to cover unexpected costs.

Tracking every expense—using apps, spreadsheets, or a simple notebook—helps you spot where money leaks occur and adjust your spending habits.

Over time, this makes managing student finances far less stressful and ensures you live within your means while still enjoying university life.

2. Maximising Student Discounts and Perks:

One of the smartest ways to stretch your student budget in the UK is by taking full advantage of the wide range of student discounts and perks available. Whether you’re shopping for groceries, travelling across cities, or looking for cheaper tech and entertainment, being a student opens doors to exclusive savings opportunities

👉Get a TOTUM or NUS Card

A TOTUM Card (formerly NUS Extra) is the official UK student discount card backed by the National Union of Students (NUS).

It’s available to all students in higher or further education, including international students. The card costs around £14.99 per year, or less with multi-year options, and offers 10–20% off at top brands such as Co-op, ASOS, Boots, and Amazon Student

You can also upgrade to TOTUM + ISIC (International Student Identity Card) to access global student travel, food, and entertainment discounts.

👉Rail and Transport Savings

Transportation costs can add up quickly, but there are plenty of ways to save when travelling as a student.

- 16–25 Railcard – Save 1/3 off train fares across the UK for just £30 per year. It pays for itself after a few long-distance trips and can be used digitally via the Railcard app.

- 18+ Student Oyster Photocard – If you’re studying in London, you can save 30% on Travelcards and Bus & Tram Passes.

- Local Council Transport Schemes – Some councils, especially in university towns like Manchester and Nottingham, offer free or discounted bus passes. Check your local council’s website for current offers.

👉Tech and Entertainment Deals

Students in the UK get some of the best tech and entertainment discounts — if you know where to look.

- UNiDAYS and Student Beans are free student verification platforms that offer discounts from Apple (up to £300 off MacBooks), Spotify (50% off Premium), and Amazon Prime Student (6-month free trial plus 50% off membership).

- For culture lovers, the National Art Pass Student Membership offers free or reduced entry to over 200 museums and galleries across the UK — including the Tate, National Gallery, and Design Museum.

Don’t forget: Always log in via your verified student platform (UNiDAYS or Student Beans) before checkout, as most online retailers only activate discounts through these portals.

👉Health and Well-being Perks

Looking after your health doesn’t have to cost a fortune. UK students can access several free or discounted healthcare benefits through the NHS and their universities.

- NHS Dental Exemptions – If you’re under 19 and in full-time education, you’re eligible for free NHS dental care. Students aged 19 and above with low incomes can apply for the NHS Low Income Scheme (HC1 form) to receive free or reduced-cost prescriptions, dental care, and eye tests.

- University Gyms and Sports Centres – Many universities (like University of Manchester Sport and UCL Sport) offer discounted gym memberships, fitness classes, and wellness programs — often 30–50% cheaper than private gyms.

3. Shop Second-Hand for Clothes, Books, and Furniture:

Buying second-hand is one of the easiest ways to save 50–80% on essentials while studying in the UK — and it’s eco-friendly too.

- Online Marketplaces–Use trusted resale platforms like Vinted, Depop, and Facebook Marketplace to grab budget-friendly clothes, shoes, and even course books.

Many UK universities also have student buy/sell groups on Facebook where you can pick up used textbooks, kitchen items, or dorm furniture at a fraction of the cost. - Charity and Local Shops Visit- charity stores such as Oxfam or the British Heart Foundation for quality second-hand clothes, homeware, and study furniture. You’ll not only save money but also support a good cause.

4. Cook at Home and Batch Meal Prep:

Cooking at home is one of the easiest and most effective ways to save money while studying in the UK. By planning your meals, shopping smart, and cooking in bulk, you can easily cut your food expenses by 30–40%.

Here’s how to make it work:

- Plan weekly menus using trusted UK recipe sites like BBC Good Food. Stick to simple, budget-friendly dishes that use overlapping ingredients to avoid waste.

- Shop smart at Aldi or Lidl, where your weekly essentials can cost around £20–£30, saving you up to 30% compared to Tesco or Sainsbury’s.

- Batch cook affordable meals such as pasta bakes, curries, or stir-fries. You can make each portion for just £1–£2.

- Share and save — cook together with your flatmates to split grocery costs and reduce leftovers.

- Use money-saving apps like Too Good To Go to grab £3 surplus bags from nearby supermarkets, bakeries, or cafes.

5. Leverage Free University Resources:

Many UK universities offer a wide range of free resources and student perks that can help you save hundreds of pounds each year—if you know where to look. Make the most of what’s already available to you before paying for external services.

- Use free facilities – Most universities provide free gym access, mental health counselling, and career advice through the student wellbeing or careers centre.

- Get premium software for free – Log in to your university portal to access tools like Microsoft 365, Adobe Creative Cloud, and SPSS without paying extra license fees.

- Take advantage of library perks – University libraries often include printing credits, study rooms, and loaner laptops for students who need them.

- Join student societies – Pay small annual memberships (usually £10–£20) to enjoy subsidised events, networking opportunities, and budget-friendly social activities.

- Apply for hardship funds – If you face financial struggles, apply early for university hardship grants, which can offer up to £3,000 in non-repayable support depending on eligibility.

- Get premium software for free – Log in to your university portal to access tools like Microsoft 365, Adobe Creative Cloud, and SPSS without paying extra license fees.

6. Invest in a Railcard or Bus Pass:

Transportation can be expensive for UK students, but smart planning with railcards, bus passes, and cycle schemes can save hundreds annually.

- 16–25 Railcard: Costs £30/year and saves 1/3 on most train fares across the UK, often paying for itself after just 1–2 trips. Combine with an Oyster Card for off-peak London travel discounts.

- Student bus passes: Cities like Manchester, Leeds, and Bristol offer discounted or free bus passes for students. Many universities provide free shuttle services to and from campuses. Use apps like Citymapper to find the cheapest and fastest routes.

- Cycle schemes: Take advantage of Boris Bikes in London (£1.65/30 mins) or university bike hire schemes, often under £50/term, for eco-friendly and cost-effective travel.

7. Pick Up a Flexible Side Hustle:

Earning extra money while studying in the UK is easier than you think, especially if you focus on flexible, student-friendly opportunities.

- On-campus jobs: Check your university job boards for roles like barista, library assistant, or campus ambassador, typically paying £10–£12/hour. Many UK universities in London, Manchester, Birmingham, and Glasgow offer part-time positions specifically for students.

- Gig economy apps: Platforms like Deliveroo or Uber Eats can earn you £50–£100/week, depending on hours and location. Ideal for cities with high delivery demand like London, Leeds, or Bristol.

- Freelance opportunities:

- Sell study notes on Stuvia.

- Offer tutoring on Superprof UK at £15–£20/hour

8. Budget Nights Out with Cash and Pre-Planning:

Going out doesn’t have to drain your student budget — smart planning and using student deals can keep costs low while still having fun.

- Bring cash: Set a spending limit of £20–£30 to avoid overspending on cards.

- Check student deals: Platforms like Student Beans often have 2-for-1 offers on entry or drinks at popular bars and clubs.

- Pre-drinks and cheap options: Drink at home before heading out or visit budget-friendly chains like Wetherspoons, where pints start at £4. Take advantage of free university balls or sober social events.

- Join societies: Many student societies offer subsidised trips and events for £5–£10, compared to spending £50+ going solo.

9. Build an Emergency Fund Early:

Having a financial safety net is essential for UK students to cover unexpected costs without stress.

- Start small: Save £10–£20 per week in a high-interest student ISA, such as those offered via the Chase app, earning up to 5% interest.

- Set a target: Aim to build 1–3 months of living expenses (£300–£900) for emergencies like laptop repairs, medical costs, or travel delays.

- Automate savings: Use apps like Plum to round up spare change and invest it automatically for passive growth.

Conclusion:

Saving money as a UK student is all about smart budgeting, using discounts, and practical habits. Track your spending, cook at home, shop second-hand, and take advantage of student perks, free university resources, and transport deals like railcards and bus passes.

Frequently Asked Questions

How to save money as a student in the UK?

To save money as a student in the UK, create a realistic budget, track your spending, and prioritise essentials. Cook at home, use student discounts, buy second-hand items, and travel with railcards or bus passes. Save a small amount monthly to build an emergency fund.

How to save 10k in 1 year in UK?

To save £10k in a year, budget strictly using the 50/30/20 rule, cut non-essential spending, cook at home, use student/loyalty discounts, work part-time or freelance, and automate savings into a high-interest account or ISA.

What is the 50/30/20 rule in the UK?

The 50/30/20 rule in the UK divides income into 50% essentials, 30% wants, and 20% savings or debt. It helps students in London, Manchester, Birmingham, and other UK cities budget effectively.

Can I work part-time as a student in the UK?

Yes, UK students can work up to 20 hours/week during term and full-time in holidays. Options include on-campus jobs, tutoring, and gig apps in cities like London, Manchester, and Birmingham

Related Articles:

Career Counselling for UK University Students: How Early Should Start?

Find out when UK university students should start career counselling,...

Read MoreWhy Career Counselling Can Make Your Future Success in the UK

Confused about your career in the UK? Learn how career...

Read MoreTop 10 AI Study Tools Every UK Student Should Use in 2026

Boost your studies with the top AI Study Tools For...

Read More