Explore the top 10 benefits of hiring an education consultant...

Read More

Who’s Eligible for Student Finance England in 2026? Complete Eligibility Guide

Applying to university is exciting — but also expensive. That’s where Student Finance England (SFE) comes in. Before you can apply for tuition or maintenance loans, you need to make sure you’re eligible.

Understanding who qualifies (and who doesn’t) can save you time, stress, and disappointment later. In this guide, we’ll walk through exactly who’s eligible for Student Finance England — from your residency and course type to age limits and special circumstances.

What Is Student Finance England (SFE)?

SFE (managed through the Student Loans Company on behalf of the UK government) administers the main student loans and some non-repayable support for students in England.

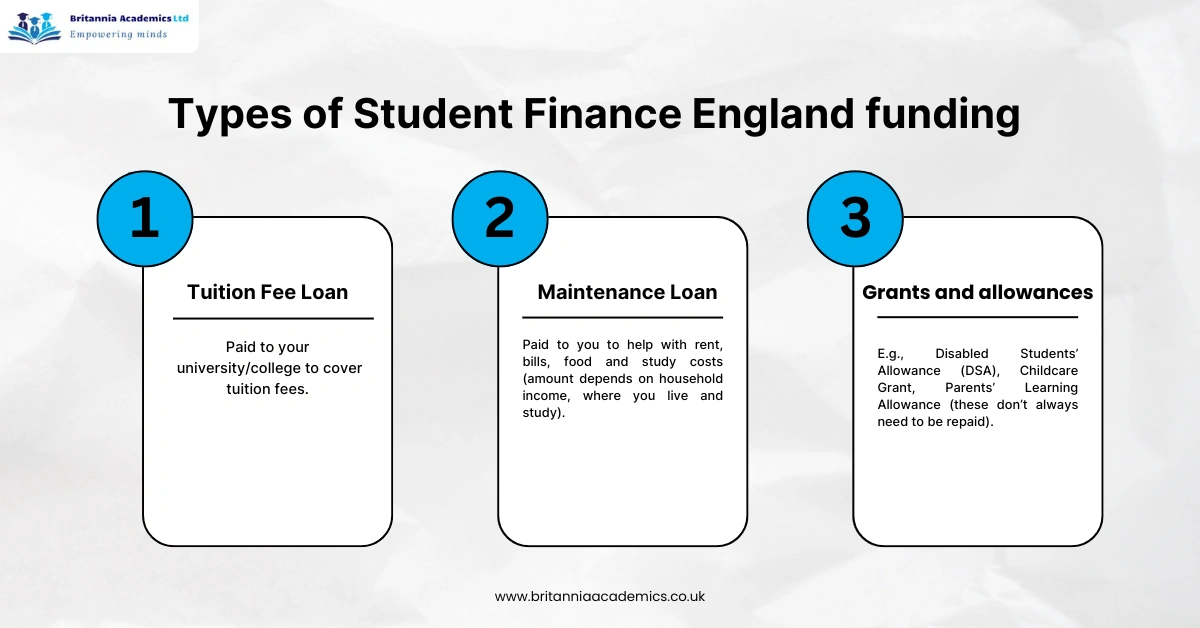

The main types of funding are:

- Tuition Fee Loan — paid to your university/college to cover tuition fees.

- Maintenance Loan — paid to you to help with rent, bills, food and study costs (amount depends on household income, where you live and study).

- Grants and allowances — e.g., Disabled Students’ Allowance (DSA), Childcare Grant, Parents’ Learning Allowance (these don’t always need to be repaid).

You start repaying these loans only after you finish your course and earn above the repayment threshold.

Course Eligibility: Does Your Course Qualify?

Courses that typically qualify:

Courses that usually don’t qualify:

- Private short courses or professional certificates without SFE approval.

- Short non-accredited training, or one-off CPD modules (unless included in an approved qualification).

Tip: You can check if your course qualifies on the official Gov website or by asking our expert university’s admissions team.

University or College Eligibility

Even if your course qualifies, your institution must be officially recognised or approved for public funding.

This includes:

- Most UK universities and government-funded colleges

- Some private institutions partnered with accredited universities

If your course is offered through a franchise or partner college, double-check that the awarding body (university) is on the SFE-approved list.

Residency and Nationality Requirements

Your residency status is one of the most important factors for Student Finance England eligibility.

You’ll usually qualify if:

- You’re a UK national or have “settled status” (no restrictions on how long you can stay in the UK), and

- You’ve lived in the UK, Channel Islands, or Isle of Man for at least 3 years before your course starts.

Special Cases That May Also Qualify:

You might still be eligible if you’re:

- An EU, EEA, or Swiss citizen with settled or pre-settled status under the EU Settlement Scheme.

- A refugee, a stateless person, or a person with humanitarian protection.

- A child of a Turkish worker in the UK.

- An Irish citizen living in the UK or the Republic of Ireland (covered by the Common Travel Area agreement).

Your eligibility depends on your immigration status and how long you’ve lived in the UK. Always check the latest official guidance.

Student Finance for EU, EEA & International Students

Since Brexit, eligibility rules for EU and EEA students have changed significantly.

1. EU/EEA Students:

You can apply for SFE funding only if:

- You have a settled or pre-settled status under the EU Settlement Scheme, and

- You’ve lived in the UK for at least 3 years before your course starts.

Otherwise, you may be classed as an international student and won’t be eligible for SFE loans.

2. International Students

Most international students are not eligible for Student Finance England.

However, some universities offer:

- International scholarships or bursaries

- Private student loans

- Commonwealth or Chevening Scholarships

If you’re an international student, contact your university’s international office for funding advice.

Special Circumstances and Extra Support

SFE offers additional support for students facing financial or personal difficulties.

You may qualify for additional support if you’re:

- Disabled or have a long-term health condition → apply for Disabled Students’ Allowance (DSA).

- A parent or carer → apply for Childcare Grant, Parents’ Learning Allowance, or Adult Dependants’ Grant.

- A care leaver or estranged from your family → access extra maintenance or university hardship funds.

- From a low-income household → get higher maintenance loan amounts or university bursaries.

Common Reasons for Ineligibility

Sometimes, students are rejected for reasons they didn’t expect. Here are the most common ones:

- You haven’t lived in the UK long enough (less than 3 years).

- You’re not a UK national or don’t have the right visa status.

- SFE doesn’t approve your course or college.

- You’ve already had funding for a previous course.

- You missed the application deadline or submitted incomplete documents.

Solution: You can appeal or provide additional documents to prove your eligibility. Always contact SFE early if there’s an issue.

Conclusion: Know Before You Apply

Student Finance England exists to make university more accessible — but eligibility rules can be complex.

If you:

- Live in England,

- Are studying an approved course at a recognised university, and

- Meet the nationality and residency requirements —

Then you’re likely eligible for financial support.

Apply early — missing documentation is the most common avoidable delay. If you’re unsure, use the Student Finance calculator or SFE helpline for a quick check or contact Our Advisor.

Frequently Asked Questions

Who is eligible to apply for Student Finance England?

You must meet personal-eligibility (residency/nationality), course-eligibility (approved HE qualification) and institution-eligibility criteria.

What are the residency requirements for SFE funding?

Generally, you must normally live in England and have been living in the UK, Channel Islands or Isle of Man for 3 years before the first day of the course.

Which types of courses qualify for Student Finance England support?

Courses like full-time undergraduate degrees (BA, BSc), foundation degrees, HNC/HND, and teacher training (approved) are typically eligible.

If I’ve already studied a degree, can I still apply for SFE finance for a new course?

Usually, you’ll only get full funding for your first higher-education qualification. Some limited funding may be possible in certain circumstances.

Related Articles:

Career Counselling for UK University Students: How Early Should Start?

Find out when UK university students should start career counselling,...

Read MoreWhy Career Counselling Can Make Your Future Success in the UK

Confused about your career in the UK? Learn how career...

Read MoreTop 10 AI Study Tools Every UK Student Should Use in 2026

Boost your studies with the top AI Study Tools For...

Read More